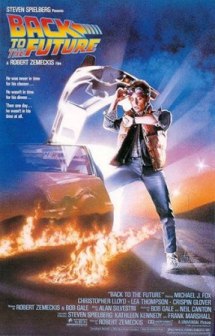

Time to grab Dr. Emmett Brown’s DeLorean and go back in time to the last big nationwide housing market dislocation, which of course was the charming and bucolic time otherwise known as the Great Depression. According to an article in Bankrate.com by Holden Lewis, there were quite a few similarities between the mortgage products that were offered by financial institutions in the years leading up to the Depression and the garden variety subprime lender of a few years ago.

Of particular note are the following two paragraphs …

In a research report for the Federal Reserve Bank of America, authors Matthew Chambers, Carlos Garriga and Don E. Schlagenhauf wrote: “Prior to the Great Depression, the typical mortgage contract had a maturity of less than 10 years, a loan-to-value ratio of about 50 percent, repayment of interest only during the life of the contract and a balloon payment at expiration.”

Except for the low loan-to-value ratios, mortgages in the early part of the 20th century were similar to the subprime and interest-only loans that were all the rage in the first years of this century. In both eras, interest-only loans were popular. In both eras, the mortgages were time bombs: In the early 1900s, the entire loan amount was due in a lump sum after a few years; in the early 2000s, the initial interest rate on an ARM was due to skyrocket after a few years. In both eras, homeowners were expected to refinance themselves out of peril.

Hello McFly!

I’ve heard quite a few folks on TV praise the “innovative” mortgage products that raised homeownership levels across the country — and these innovations used as a rationale against more stringent regulation. But as you can see, the only innovation that seems to have taken place is the way the loans were chopped up and sold off to investors throughout the financial system. The loan product itself is an old idea, and one that works only in small doses and only under certain conditions.

So what happened to turn the housing crisis in the Depression? I don’t have a flux capacitor handy … but lucky for us, Bankrate’s article is instructive …

In 1933, the federal government created an agency called the Home Owners Loan Corp., or HOLC, which within three years bought one-fifth of the nation’s residential mortgages. The HOLC bailed out the owners by converting their loans to something novel: long-term, fixed-rate, amortizing mortgages. The federal government followed up by creating the Federal Housing Administration in 1934, and the 30-year-fixed with a small down payment quickly became the dominant mortgage for home purchases. The Depression-era government bailout of delinquent homeowners succeeded, and the homeownership rate climbed rapidly for three decades.

In essence the plain, vanilla, fuddy-duddy, fixed-rate 30-year mortgage WAS the innovation that emerged to fix a broken system. And it came to us not from the banking sector, but from the federal government.

My point is not to argue for more government regulation and intervention in the housing market necessarily – that’s for others to consider. But it is interesting to learn that we’ve seen really bad times in the housing market before … and that sadly, many borrowers are learning the lessons of history at the hands of lending institutions that should have known better.

Filed under: Subprime Lending |

Alas, neither today’s underwriters nor its mortgagees were kicking around with Herbert Hoover. Historians didn’t forget. Regular people did.